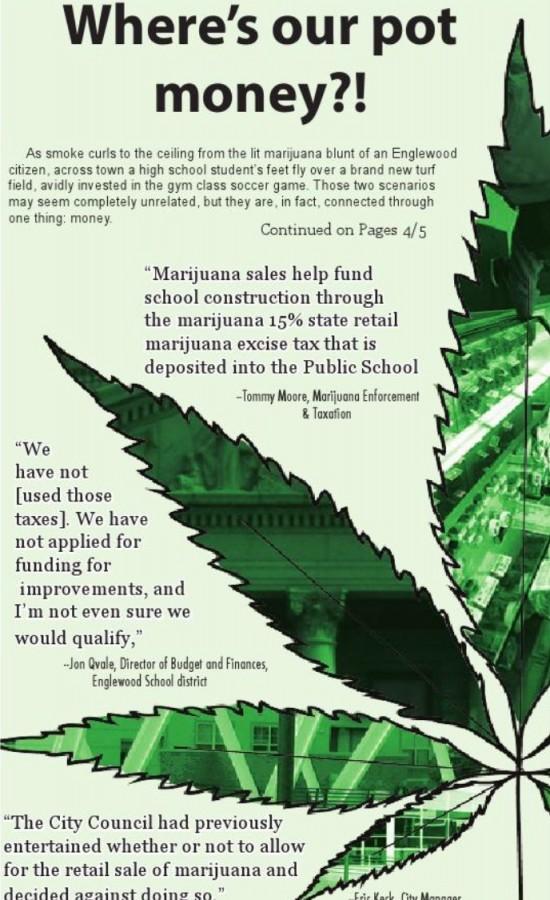

Where’s our pot money?

November 30, 2015

As smoke curls to the ceiling from the lit marijuana blunt of an Englewood citizen, across town a high school student’s feet fly over a brand new turf field, avidly invested in the gym class soccer game. Those two scenarios may seem completely unrelated, but they are, in fact, connected through one thing: money.

In 2012, Colorado passed Amendment 64, legalizing the use of recreational marijuana. The amendment declared that part of the profit from the newly legalized marijuana trade must go to funding public schools in Colorado. Because of this, public school districts across the state had, and still have, the opportunity to start receiving money from the $40 million (from taxed marijuana sales) set aside specifically for schools.

“Marijuana sales help fund school construction through the marijuana 15% state retail marijuana excise tax that is deposited into the Public School Construction Fund. The excise tax is applied when marijuana is transferred or sold from a marijuana grower to a marijuana store,” Tommy Moore, Communications Specialist for Marijuana Enforcement & Taxation for the Colorado Department of Revenue said.

However, not every school district across Colorado is reaping the benefits from Amendment 64. Englewood is one such school district that receives no money from the taxation of the marijuana trade.

“We have not [used those taxes]. We have not applied for funding for improvements, and I’m not even sure we would qualify,” Jon Qvale, Director of Budget and Finances for the Englewood School district said.

This lack of funding from marijuana sales to the Englewood School District stems from the fact that Englewood doesn’t even have recreational marijuana stores to take taxes from.

“15% is distributed back to local governments that pay into it. Englewood does not have licensed retail marijuana stores, so there is no 10% special state retail marijuana sales tax collected from the city, thus they do not receive a portion of that distribution,” Moore explains.

Compared to the local governments that do “pay into it”, Englewood is missing out on receiving between $1,700 (the amount Carbondale receives) to $292,653 (the amount Denver receives) from marijuana taxes.

Englewood High School doesn’t even receive funds from the marijuana stores on Broadway because the stores sell medical marijuana, not recreational.

“The City Council had previously entertained whether or not to allow for the retail sale of marijuana and decided against doing so. They believed that the close proximity of a number of retail sales outlets in Denver along the Broadway corridor would satisfy the market’s need and demand,” said Eric Keck, City Manager of Englewood.